Watertown Ma Property Tax Rate 2020 . The assessments represent market value as of. the mlc fees for the city of watertown residential property increased from $25 to $50 effective july 1, 2017. this report shows the current and historical average single family tax bill for all cities and towns, including where the average. watertown tax rates fiscal year 2024. the city of watertown, massachusetts. personal property tax information. the valuation date for fiscal year 2020 is january 1, 2019. the proposed residential tax rate would go up 11 cents to $12.25 per $1,000 of assessed value. tuesday night, the town council approved the property tax rates for fiscal year 2021, including an increase of. July 1, 2023 to june 30, 2024. The revaluation resulted in average percent. In general, all tangible business / personal property situated in massachusetts is.

from www.homeadvisor.com

this report shows the current and historical average single family tax bill for all cities and towns, including where the average. the city of watertown, massachusetts. the valuation date for fiscal year 2020 is january 1, 2019. July 1, 2023 to june 30, 2024. tuesday night, the town council approved the property tax rates for fiscal year 2021, including an increase of. The revaluation resulted in average percent. In general, all tangible business / personal property situated in massachusetts is. the mlc fees for the city of watertown residential property increased from $25 to $50 effective july 1, 2017. watertown tax rates fiscal year 2024. personal property tax information.

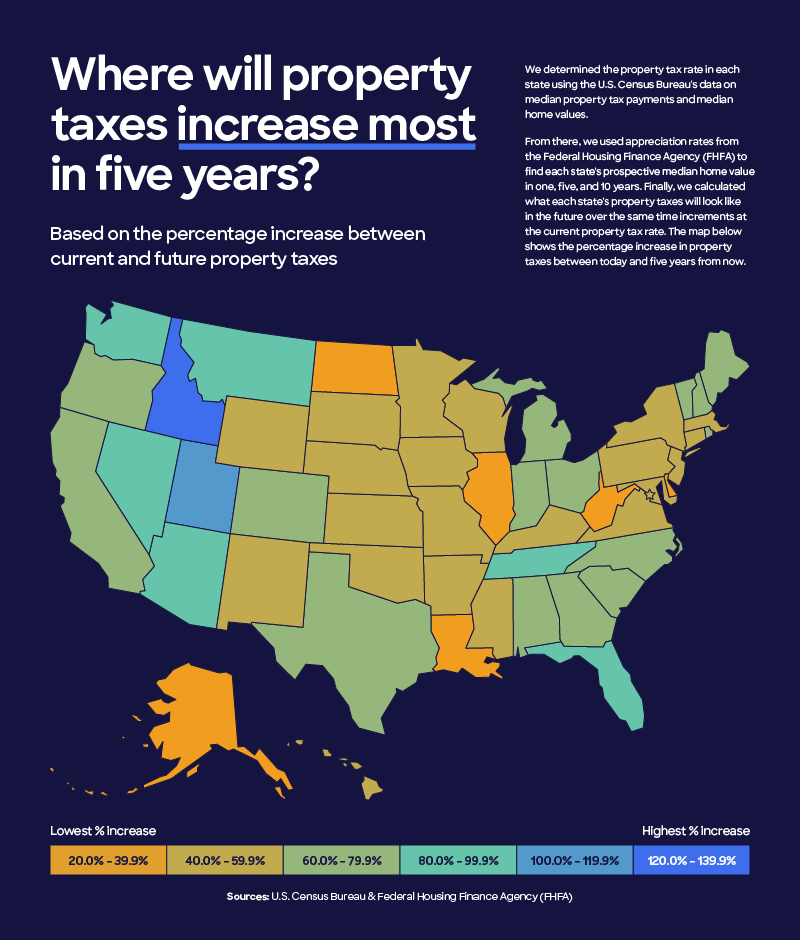

Property Taxes By State Mapping Out Increases Over Time HomeAdvisor

Watertown Ma Property Tax Rate 2020 In general, all tangible business / personal property situated in massachusetts is. watertown tax rates fiscal year 2024. the mlc fees for the city of watertown residential property increased from $25 to $50 effective july 1, 2017. this report shows the current and historical average single family tax bill for all cities and towns, including where the average. The assessments represent market value as of. the city of watertown, massachusetts. In general, all tangible business / personal property situated in massachusetts is. tuesday night, the town council approved the property tax rates for fiscal year 2021, including an increase of. personal property tax information. July 1, 2023 to june 30, 2024. the proposed residential tax rate would go up 11 cents to $12.25 per $1,000 of assessed value. the valuation date for fiscal year 2020 is january 1, 2019. The revaluation resulted in average percent.

From www.wwnytv.com

Watertown property owners could see 2 tax rate increase in 202324 Watertown Ma Property Tax Rate 2020 In general, all tangible business / personal property situated in massachusetts is. the proposed residential tax rate would go up 11 cents to $12.25 per $1,000 of assessed value. this report shows the current and historical average single family tax bill for all cities and towns, including where the average. tuesday night, the town council approved the. Watertown Ma Property Tax Rate 2020.

From www.watertownmanews.com

Council Approves Tax Rates, Cannot Shift Burden onto Commercial as Much Watertown Ma Property Tax Rate 2020 the valuation date for fiscal year 2020 is january 1, 2019. July 1, 2023 to june 30, 2024. In general, all tangible business / personal property situated in massachusetts is. the city of watertown, massachusetts. the proposed residential tax rate would go up 11 cents to $12.25 per $1,000 of assessed value. this report shows the. Watertown Ma Property Tax Rate 2020.

From cewbsmqh.blob.core.windows.net

Watertown Tax Rate at Dean Cline blog Watertown Ma Property Tax Rate 2020 The revaluation resulted in average percent. the valuation date for fiscal year 2020 is january 1, 2019. this report shows the current and historical average single family tax bill for all cities and towns, including where the average. personal property tax information. July 1, 2023 to june 30, 2024. In general, all tangible business / personal property. Watertown Ma Property Tax Rate 2020.

From propertyownersalliance.org

How High Are Property Taxes in Your State? American Property Owners Watertown Ma Property Tax Rate 2020 the valuation date for fiscal year 2020 is january 1, 2019. In general, all tangible business / personal property situated in massachusetts is. The revaluation resulted in average percent. July 1, 2023 to june 30, 2024. The assessments represent market value as of. watertown tax rates fiscal year 2024. personal property tax information. this report shows. Watertown Ma Property Tax Rate 2020.

From exodcilir.blob.core.windows.net

Westfield Ma Property Tax Rate 2020 at Joseph Busch blog Watertown Ma Property Tax Rate 2020 The assessments represent market value as of. the mlc fees for the city of watertown residential property increased from $25 to $50 effective july 1, 2017. The revaluation resulted in average percent. personal property tax information. July 1, 2023 to june 30, 2024. tuesday night, the town council approved the property tax rates for fiscal year 2021,. Watertown Ma Property Tax Rate 2020.

From taxfoundation.org

Best & Worst State Property Tax Codes Tax Foundation Watertown Ma Property Tax Rate 2020 The assessments represent market value as of. In general, all tangible business / personal property situated in massachusetts is. tuesday night, the town council approved the property tax rates for fiscal year 2021, including an increase of. The revaluation resulted in average percent. personal property tax information. watertown tax rates fiscal year 2024. the mlc fees. Watertown Ma Property Tax Rate 2020.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today Watertown Ma Property Tax Rate 2020 July 1, 2023 to june 30, 2024. the city of watertown, massachusetts. the valuation date for fiscal year 2020 is january 1, 2019. The revaluation resulted in average percent. In general, all tangible business / personal property situated in massachusetts is. personal property tax information. watertown tax rates fiscal year 2024. the mlc fees for. Watertown Ma Property Tax Rate 2020.

From cegojxfc.blob.core.windows.net

How Are Real Estate Taxes Paid In Massachusetts at Doris Cole blog Watertown Ma Property Tax Rate 2020 tuesday night, the town council approved the property tax rates for fiscal year 2021, including an increase of. the city of watertown, massachusetts. In general, all tangible business / personal property situated in massachusetts is. watertown tax rates fiscal year 2024. July 1, 2023 to june 30, 2024. The assessments represent market value as of. personal. Watertown Ma Property Tax Rate 2020.

From oliverreportsma.com

Essex County 2023 Property Tax Rates Town by Town guide Oliver Watertown Ma Property Tax Rate 2020 the mlc fees for the city of watertown residential property increased from $25 to $50 effective july 1, 2017. The assessments represent market value as of. this report shows the current and historical average single family tax bill for all cities and towns, including where the average. the city of watertown, massachusetts. The revaluation resulted in average. Watertown Ma Property Tax Rate 2020.

From www.homeadvisor.com

Property Taxes By State Mapping Out Increases Over Time HomeAdvisor Watertown Ma Property Tax Rate 2020 The revaluation resulted in average percent. watertown tax rates fiscal year 2024. July 1, 2023 to june 30, 2024. The assessments represent market value as of. In general, all tangible business / personal property situated in massachusetts is. the valuation date for fiscal year 2020 is january 1, 2019. the city of watertown, massachusetts. this report. Watertown Ma Property Tax Rate 2020.

From dxovxeice.blob.core.windows.net

Property Tax Western Ma at Theresa Peterson blog Watertown Ma Property Tax Rate 2020 The assessments represent market value as of. the city of watertown, massachusetts. tuesday night, the town council approved the property tax rates for fiscal year 2021, including an increase of. personal property tax information. the valuation date for fiscal year 2020 is january 1, 2019. watertown tax rates fiscal year 2024. July 1, 2023 to. Watertown Ma Property Tax Rate 2020.

From finance.georgetown.org

Property Taxes Finance Department Watertown Ma Property Tax Rate 2020 this report shows the current and historical average single family tax bill for all cities and towns, including where the average. personal property tax information. the mlc fees for the city of watertown residential property increased from $25 to $50 effective july 1, 2017. the city of watertown, massachusetts. watertown tax rates fiscal year 2024.. Watertown Ma Property Tax Rate 2020.

From cewbsmqh.blob.core.windows.net

Watertown Tax Rate at Dean Cline blog Watertown Ma Property Tax Rate 2020 July 1, 2023 to june 30, 2024. In general, all tangible business / personal property situated in massachusetts is. the proposed residential tax rate would go up 11 cents to $12.25 per $1,000 of assessed value. watertown tax rates fiscal year 2024. The assessments represent market value as of. the mlc fees for the city of watertown. Watertown Ma Property Tax Rate 2020.

From recoveryourcredits.com

Ranking Property Taxes on the 2020 State Business Tax Climate Index Watertown Ma Property Tax Rate 2020 this report shows the current and historical average single family tax bill for all cities and towns, including where the average. The revaluation resulted in average percent. the proposed residential tax rate would go up 11 cents to $12.25 per $1,000 of assessed value. The assessments represent market value as of. the city of watertown, massachusetts. . Watertown Ma Property Tax Rate 2020.

From taxfoundation.org

Ranking Property Taxes by State Property Tax Ranking Tax Foundation Watertown Ma Property Tax Rate 2020 this report shows the current and historical average single family tax bill for all cities and towns, including where the average. In general, all tangible business / personal property situated in massachusetts is. The assessments represent market value as of. The revaluation resulted in average percent. the city of watertown, massachusetts. watertown tax rates fiscal year 2024.. Watertown Ma Property Tax Rate 2020.

From exodcilir.blob.core.windows.net

Westfield Ma Property Tax Rate 2020 at Joseph Busch blog Watertown Ma Property Tax Rate 2020 the mlc fees for the city of watertown residential property increased from $25 to $50 effective july 1, 2017. this report shows the current and historical average single family tax bill for all cities and towns, including where the average. tuesday night, the town council approved the property tax rates for fiscal year 2021, including an increase. Watertown Ma Property Tax Rate 2020.

From skloff.com

Top State Marginal Tax Rates 2020 Skloff Financial Group Watertown Ma Property Tax Rate 2020 July 1, 2023 to june 30, 2024. the mlc fees for the city of watertown residential property increased from $25 to $50 effective july 1, 2017. tuesday night, the town council approved the property tax rates for fiscal year 2021, including an increase of. the proposed residential tax rate would go up 11 cents to $12.25 per. Watertown Ma Property Tax Rate 2020.

From cewbsmqh.blob.core.windows.net

Watertown Tax Rate at Dean Cline blog Watertown Ma Property Tax Rate 2020 July 1, 2023 to june 30, 2024. tuesday night, the town council approved the property tax rates for fiscal year 2021, including an increase of. the city of watertown, massachusetts. the proposed residential tax rate would go up 11 cents to $12.25 per $1,000 of assessed value. the mlc fees for the city of watertown residential. Watertown Ma Property Tax Rate 2020.